Introduction

This is the first of a multi-part series of articles about Crude oil and the role it plays in economies throughout the world. I have broken up the topics in order to make for easy reading.

In this installment, we will discuss Crude oil properties, where it is found, how it is recovered (extracted), and how the properties of a particular crude oil determine where/how it is used (refined). Future installments will cover

· Logistics for delivery of crude to destination refineries.

· Global trade in crude oil; Key players in production and consumption.

· Outlook for the future of crude oil: Will fossil fuels become obsolete?

To keep things a little more interesting, I will include some discussion/conclusions with regard to global impacts of the information contained in each installment. For example, in this first part, I will include discussion about the G7/EU-imposed “Price Cap” on Russian crude.

What is Crude Oil?

Crude oil (“crude”) is a mixture of hydrocarbons, which are molecules that contain carbon and hydrogen, and sometimes oxygen or other elements, in their molecular structure. Crude also contains impurities, such as acids, salts, and metals.

The simplest hydrocarbon, methane (one carbon bonded to four hydrogen atoms), is the main ingredient in natural gas, and it is often found in geologic structures that contain crude. So, when a company drills for oil, they often also find natural gas. Natural gas is important in its own right, and it is a valuable commodity in the world today.

While methane contains one carbon atom in its structure, the other molecules in crude can contain two, three…up to 20 or more carbon atoms in their structures. With the various permutations of structures that can be formed, crude can contain hundreds of different hydrocarbon products. It is the job of the refineries to separate the crude mixture into the useful products that society depends upon for everyday living. Some of the products from refineries are themselves mixtures of hydrocarbons, such as gasoline (four- to twelve- carbon chains) and diesel fuel (ten- to twenty- carbon chains). Other products consist of a single, purified hydrocarbon, such as toluene or propylene, which are building blocks for other useful products such as food preservatives or plastics. We will discuss this in more detail in a future installment.

Crude Oil Physical Properties

While we see headlines like “Crude Price Skyrockets, Could go to $100 per Barrel”, it is important to understand that the term “crude” can refer to any one of several hundred types of oil that are on the world market today. Even crudes from a single country can have vastly different properties. It is these properties that determine the value of any given crude. From a refiner’s perspective, there are seven characteristics of crude that (roughly) determine the value of the crude. These properties are:

· API Gravity

· Sulfur Content

· Total Acid Number (TAN)

· Metals Content

· Pour Point

· Viscosity

· Boiling Range (profile)

We will discuss the first four properties to keep things brief.

API gravity is an indirect measure of how dense the oil is, i.e., the kilograms per cubic meter (or lb/gallon). The API gravity of an oil is an indication of the molecular weight of the hydrocarbon molecules that make up that oil.

The API gravity is unit-less, meaning that it is expressed as a number, without the kg/cbm or lb/gallon units. This is because gravity is a ratio of the density of the oil divided by the density of water at a given temperature. API gravity numbers are inversely related to density. For example, API gravity of 10 means the oil density is equal to the density of water, and any value above 10 means the oil density is less than the density of water (BTW, water is actually quite a dense liquid compared to hydrocarbons). Crude with an API gravity of 10 is considered very heavy, while an API gravity of 30 would be an oil that is of medium density. Some crudes have API gravities in the 50s, and they are very light. A higher API gravity oil would be expected to yield more of the lower molecular weight components, such as gasoline, while a lower API gravity oil would be expected to yield more of the higher molecular weight components, such as diesel.

Sulfur in this context refers to sulfur-containing compounds in the crude, that can make their way into the finished gasoline or diesel. There is a different sulfur compound, hydrogen sulfide, that is a gas, but is often entrained in crude products. This gas is deadly, and must be monitored for worker safety in the handling and processing of crude oil.

“Sweet” crude has low sulfur content, and “Sour” crude has high sulfur. The sulfur must be removed in a process called hydrodesulfurization, and it adds cost in the refining process. Thus, a sweet crude has more intrinsic value than a sour crude with similar API gravity and other properties.

Acidity (Total Acid Number) can be present due to oxidation of some of the hydrocarbons into acid over time. Acidity must be removed because it can be corrosive to the metal equipment in the refinery.

Metals can deactivate the catalysts used in some of the steps in refining, and must be removed before these steps in the refining process.

In addition to the properties above, the Boiling Range gives an idea of how much of each type of petrochemical product can be extracted from the crude. This includes gasoline, kerosene, diesel, etc.

A final point in this section: Many people (especially politicians) think that one crude oil is just like any other crude oil. But that cannot be further from the truth. As we will see below, refineries are built to handle a particular range of crude oils, so that they can make the products that are in greatest demand in their geographic vicinity. This is a critical point in the current geopolitical situation, especially in Europe.

Different Types of Crude

There are hundreds of different “types” of crude oil, differing in the properties described above. It is easy to imagine the different combinations of properties can lead to a huge number of different crudes from around the World. Some of the best-recognized crudes are Brent (North Sea), West Texas Intermediate (WTI), and Alaska North Slope, for example. The price of each individual crude is set by market conditions, and the value of each crude can change frequently.

Additionally, many refineries are designed to efficiently process blends of different crudes, such that the input oil composition matches the capability of each section of the refinery in a way that the refinery can run all of its units at optimum rates. Even a small “tweak” of rates can mean millions of dollars per year to a refinery if it can obtain the best blend of crudes for processing. This will be described in a later installment (Logistics) in this series.

Where is Crude Found?

Crude is found on all of the inhabited continents, and each geographic region that contains oil has, at one time, been in a marine environment (i.e., part of an ocean). Major oil producing regions of the world include the Middle East, North America, Eurasia (Russia, China, and adjacent countries), South America, and Africa. Some crude is even found in Australia and New Zealand!

Oil is usually found in subterranean geological structures, either on land or under the seabed in some shallow- to moderate-depth ocean water bodies. It is likely that crude is present under the seabed in very deep ocean locations, but recovery is not feasible at the present time.

How is Crude Recovered?

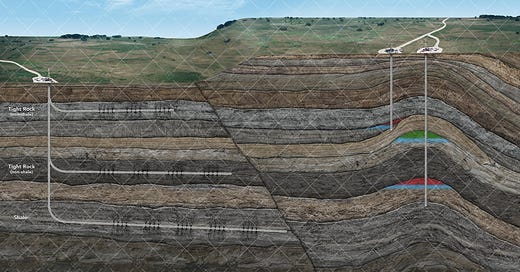

Conventional oil wells extract oil from porous rock structures, and it is quite easy to get the oil to the surface in these types of wells. It is as if the oil is in an underground reservoir. See the well depicted on the right in the image:

Conventional (vertical) drilling for crude oil has been the most common practice historically.

Within the last few decades, “tight oil” formations (e.g., shale formations) have been exploited by using newer technology. These wells were previously not economical to drill, but the higher price of crude has made this technology competitive. Tight formations consist of oil dispersed in porous, but not very permeable rock formations. The oil is recovered by hydro-fracturing the shale in place, and then pumping the oil that is freed from the rock. The “fracking” process uses water injected under extremely high pressure containing a proppant, usually sand. The pressure creates/widens fissures in the rock, and the sand “props” the fissures open to allow flow of oil (thanks to reader Bash for pointing out my previous incorrect description of the fracking process—Piquet).

While conventional crude reservoirs are usually large in both the vertical and lateral directions, shale oil formations are typically wide laterally, but shallow in the vertical dimension. Therefore, conventional vertical drilling is not capable of effectively recovering oil from such formations due to the shallowness, and the impermeability of the rock structure containing the crude. The development of directional horizontal drilling methods has made recovery of shale oil quite successful and economically viable (see the left depiction in the image above).

Another type of unconventional crude is bitumen, found in tar sands, or oil sands. Bitumen is a thick, sticky substance that is almost solid at moderate temperatures. The solid tar sand is often mined, much like ore, and it is heated to reduce viscosity and separate the crude from the sand and other solid materials. For transportation purposes, the bitumen is often diluted with light hydrocarbon mixtures called condensate in order to reduce viscosity. Additionally, the bitumen can be “cracked” to smaller molecules, and this “synthetic” crude can be used also to reduce viscosity of the untreated bitumen. Western Canada produces large quantities of crude from tar sands, and a lot of that crude is sold to refiners in the U.S.

Value of Crude

In very general terms, the value of crude is determined by the value of the components (“products”) that can be recovered from the crude, as well as the effort (“energy”) it takes to extract those products for sale. This is where refineries play an important role. Crude contains energy products, for example, gasoline, diesel, aviation fuel, and heating oil. These products are sold on a “per volume” basis, e.g., dollars per gallon or euros per liter. They are valued for their energy (heat) content.

On the other hand, crude contains many products that are valued for their chemical properties, such as ethylene and propylene (used to make plastics), benzene/toluene/xylenes (used to make a host of products), and a number of complex polycyclic compounds that are building blocks for production of, for example, pharmaceuticals and other sophisticated products. These products are sold on a weight basis, e.g., dollars per pound or euros per kilogram (or even euros per gram!). In general, chemical value is higher than fuel (heat) value.

Refinery Processes

The majority of the products that come from crude are liquids, e.g., gasoline, diesel, heating oil, lube oils, etc. Therefore, it is safe to say that many of the processes in refineries involve distillation. If that was the only technique used, though, a refinery would end up with many products that would be unusable, and need to be disposed. This is because the amount of gasoline, diesel, and other usable products in raw crude is quite low relative to the amount that is needed by the market. Therefore, refineries contain other processing sections (called “units”) that carry out chemical reactions to change the nature of some of the components of crude. These units include catalytic cracking, isomerization, hydrotreating, and other processes which we will discuss below.

Crude, as it enters the refining process, often contains very light hydrocarbons such as methane, ethane, and propane, which are gases at normal ambient conditions. The crude also may contain other gases, such as hydrogen sulfide, which is quite toxic. So, the first step is to remove these volatile products, as well as reduce the hydrogen sulfide to sulfur to remove it from the stream. The hydrocarbon gases are separated for further processing. Ethane and propane can be used to make polyethylene and polypropylene, plastics that are used in many applications worldwide.

The process described above is part of the first distillation in the refinery process, and that distillation also generates light hydrocarbons (such as butane and pentane) which are of low octane rating (“octane number” is an important measurement for gasoline). These light products can be treated in an isomerization unit to produce higher octane components that are used in gasoline.

Also recovered in this distillation step is a heavier hydrocarbon stream (seven to twelve carbon chain length) that may also be used directly in gasoline, or can be catalytically reformed to make higher octane gasoline components.

An even heavier hydrocarbon stream (8 to 16+ carbon chain length) is produced from the distillation, and this is called “middle distillate”. Further treatment is necessary in this stream, to remove sulfur that exists in the form of mercaptans (these are different from hydrogen sulfide, but still contain sulfur — which is bad). The different middle distillates are kerosene, jet fuel, and diesel fuel.

The product that is left after removing the above components is still a large fraction of the crude that was put into the process at the start. It is not useful as-is, so it is further treated in a catalytic cracker unit. As the term “cracker” implies, this process cracks the longer carbon chains into short chains, which can be cycled back to the appropriate unit in order to be used in a final product.

The heaviest stream from the atmospheric distillation contains long chain hydrocarbons as well as cyclic hydrocarbons that are not straight chains. This “residue” is sent to a coker unit, which produces some additional hydrocarbons that can be used in gasoline, but also produces petroleum coke, which is a solid carbonaceous material useful in the production of metals.

Finally, the bottoms from the distillation steps end up as asphalt, which can be used for pavement for roads.

Matching Crude(s) to a Refinery

Building a refinery is a daunting task, and it is prohibitively expensive for all except the companies with great experience. For a given location, a tremendous amount of discussion and thought is put into the decisions around the structure of the refinery and the range of products that will be produced at that site. Obviously, the inputs (crude oil and other process chemicals) and the outputs (gasoline, diesel, etc.) are commodities, and in the commodities business, low-cost logistics is a key to the success of the refinery.

“Flexibility” is not an attribute that is associated with refineries. Once built, a refinery can only accommodate a narrow range of crude oil properties in order to operate efficiently ($$). Contracts for crude oil supply to a refinery are generally established for the long term, with only a portion allowed for spot purchases. The spot purchases can be used to account for short-term or seasonal changes in demand for products. But consistency in the nature of the input crude is key to operating the refinery in an optimal manner.

Let’s look at how refinery characteristics differ between countries/regions.

Historically, North America automobile production has been geared toward gasoline-powered personal autos. Diesel engines have been used primarily in commercial heavy transportation vehicles (trucks). It is believed that ownership of personal vehicles was (and is) an ego-driven decision, and gasoline powered cars had a reputation of being fast and sleek. On the contrary, diesel-powered vehicles, while much more fuel efficient, were more expensive to buy and had a reputation of being “dirty”. Personal vehicles with diesel engines in the U.S. comprise only 4% of vehicle sales. Another factor contributing to the imbalance between gasoline and diesel is that crude oil in the U.S. has historically been lighter in API gravity, therefore the refineries naturally produced more gasoline than diesel, and gasoline was (and is) less expensive than diesel.

On the other hand, other countries have had access to crude oil of a heavier gravity, and refineries in those countries (including Europe) easily produce a large proportion of diesel fuel. So naturally the personal vehicle of choice was diesel-powered.

Up until the early 21st century, a robust import/export trade of diesel and gasoline existed between the U.S. and Europe. Economically, that trade flow could accommodate the logistics costs of shipping finished products across the Atlantic Ocean, and the excess diesel in the U.S. was absorbed by the European market, and the reverse flow for gasoline was profitable for European refiners. Within the last decade or so, Europe has begun to legislate the diesel-powered car out of existence, so the diesel flow from the U.S. has shifted to other continents, such as South America.

Europe, on the other hand, needs more gasoline than in the past, as sales of petrol-powered cars have surpassed 70% of total automobile sales in some EU countries. And Europe must find markets for the excess diesel produced by their heavy-crude refineries.

Crude Oil Price Cap

In addition to this destabilizing trend that started in the 2010s, a further upheaval arrived in 2022 with discussions to ban Russian crude in the EU because of the “war” in Ukraine. Some EU countries objected to a ban because they are landlocked and rely on pipeline deliveries, thus they do not have logistical alternatives. Others objected to an outright ban because of the fear of skyrocketing crude prices worldwide, and fears of the effect that would have on world economies.

Ultimately, the G7 settled on the idea of a price cap on Russian crude. Because of the objections of the EU countries stated above, they were exempted from the cap mechanism by imposing the cap on waterborne shipments of crude only. But Germany, the Netherlands, Italy, and other EU countries would be affected because they have historically relied on Russian crude, and their refineries were “tuned” to Russian (Urals) crude. And these countries were not exempted from implementing the cap.

Since a large number of the refineries that purchased Russian crude were built to process that type of oil, you can imagine the difficulty of finding alternate supplies that match the Urals blend from Russia. So, a lot of difficulty was anticipated with implementation of the price cap.

Let’s take a little detour and examine the details of the price cap mechanism. The basic idea is that the West (G7, EU, U.S., etc.) wanted to curtail the income that Russia was receiving from the sale of a valuable commodity. In other words, a group of customers were going to stipulate the price of the crude, with no negotiation between themselves and the supplier. That might work if the buyers were the only buyers in the marketplace. Well, the West was confident that they could pressure all of the other buyers worldwide to “fall in line” with their decree. The West was also confident that they could prevent surreptitious behavior of market participants, i.e., those who might buy Russian crude and mix it with other crudes to mask the identity of the Russian crude. What could go wrong?

Well, some time has passed and we can see how the price cap has worked out for the West, and particularly for the EU.

First, several countries have dramatically increased their purchases of Russian crude, and they have taken delivery into their systems. These same countries have also exported crude oil to G7 and EU countries, at prices above the ($60/bbl) price cap. Bear in mind that some countries have historically had purchase agreements for Urals crude at discounts to the market price. So, Russia was able to accommodate a reduction in (direct) sales to the West by increasing sales to existing customers at existing agreed prices. And those existing customers will not forget the windfall ($$) that Russia helped them achieve.

Second, let us examine the mechanism that the West is using to enforce the price cap. The cap applies to waterborne shipments, so the West is pressuring vessel owners to refuse carriage of Russian crude if the price cap is violated. They are doing that by forcing the Marine Insurance industry to refuse coverage to any vessel (or vessel owner) that does not comply with the price cap rules. Remember that Marine Insurance is an industry that has historically been ruled by Britannia (Lloyd’s of London, etc.). Well, the end result is that several countries have stepped into game and started up their own insurance industries, and they are breaking the monopoly that the West had on Marine reinsurance. I would call that an “own goal”! This doesn’t even count the so-called “ghost fleet” of older vessels that are now being put into service to increase the volume capability to carry this crude by ship, rather than by pipeline.

Third, we can determine if the price cap has worked. Has the price of Urals crude been affected by the implementation of the price cap? Let’s see:

Look at that! The price cap went into effect in December of 2022, and the price of Urals crude came down. Yay, Janet Yellen is a genius!

Well, not so fast. Look at Brent crude for the same time frame:

Brent crude price came down also in December of 2022, even though the price cap did not apply at all to Brent crude. And most other crude prices came down at that time as well. That is called “Supply and Demand”, otherwise known as “The Market.”

If you look at pricing in the second half of 2023, you can see that Urals crude has regularly traded above the price cap. And recently, the discount of Urals to Brent has been only about $5/bbl.

And finally, we can see that even the government agencies that wrote the tomes of rules for the price cap have decided to not even bother to adjust the price cap now that all crude oil prices have gone up dramatically. That is a good indication that they have “thrown in the towel” on the whole, idiotic idea that a price cap could work. One word adequately describes the whole price cap idea: sophism.

Effects on the EU

As a result of the gyrations about sanctions and price caps, we can see that the entities most damaged by the effects of bad decisions are the citizens of the EU countries that have implemented these bad ideas. Aside from decisions about natural gas (see here), the decisions around crude oil supply continue to have detrimental economic effects.

There are some large EU refineries (notably in Germany) that are running at reduced rates due to logistics issues, and also due to the quantity and different composition of the crudes that they are able to obtain now. This is a big detriment to the economic well-being of the companies that own those refineries, AND it is likely that the citizens of those countries are being hit with elevated prices of the refinery products such as diesel and petrol. Inflation and even recession are running rampant.

If you like this article, please consider buying me a coffee. A massive amount of work goes into writing a researched article like this. This is the first of ~3 installments on Crude Oil, and we have several other topics to write about in the near future. If you have any suggestions of what you would like to see, please add it in the comment section. Thank you!

Great Piquet, thanks.

In the old The Saker site, Jorge Vilches wrote a lot about the subject. Maybe some of his elements can help you in the next installments.

Dear Piquet, I really appreciate BMA's articles and yours. This one on crude oil - I look forward to the next ones! - is very interesting indeed. I very much agree with your analysis of the price cap: I wrote an article about it a few months ago, when it was beginning to look like the sanctions were not working at all, looking at the issue from a Marxist perspective. I'll put the link here (https://www.assaltoalcielo.it/2023/02/26/price-cap-sorpresa/). The text is in Italian, but if you are interested, there is a translator on the site that published it. Congratulations again! Valerio