Introduction

This is the second of a three-part series of articles about Crude oil and the role it plays in economies throughout the world. The first part discussed the properties of crude oil, and the processes used to refine crude into usable products.

In this installment, we will discuss the global trade for crude oil, and how oil is transported from wellhead to refinery. The final installment will cover the outlook for the future of crude oil. The question to address in that part is: Will fossil fuels become obsolete?

We will start with the global trade of crude oil. As mentioned in the previous segment, crude oil is found all over the world, and often in remote places where there is little/no demand for the oil. To address that, we will follow up with a discussion of the logistics required to get the oil to where it can be refined and distributed to the consumers.

Crude Oil Production

Many countries produce crude oil, but fewer than 20 countries produce more than they consume. All other countries must import crude oil, and/or petroleum products in order to satisfy petroleum demand. The term “petroleum products”, or “products” refers to gasoline, kerosene, diesel fuel, lubricants, petrochemicals, and other products, including renewable fuels. The seasonal and day-to-day variation in demand for crude and products has resulted in the capability, in many countries, to both export and import the components necessary to satisfy demand.

The following tables show the production of crude oil from some of the top producers of crude oil, as well as the oil production of most of the European countries. These tables also show the consumption of petroleum products, and because many products are independently imported/exported, the balance between oil production and products consumption in a given country is not a one-to-one comparison.

Table 1 shows the major oil-producing countries (>1 MM bbl/day), along with their consumption of petroleum products.

The major regions of crude oil production are:

Middle East (Saudi, Iraq, UAE, Iran, Kuwait, etc.)

Americas (US, Canada, Mexico, Brazil)

North Sea (UK, Norway)

Africa (Nigeria, Angola, Algeria, Libya)

Eurasia (Russia, China, Kazakhstan)

As you can see from Table 1, it is a rare circumstance in which a country produces the same amount of crude as it consumes. Further, it is unlikely that any country produces the types of crude that can be refined into the exact slate of products that that country consumes. For example, U.S. refineries produce more middle distillate (diesel, kerosene, etc.) than is consumed, and the U.S. has historically needed more gasoline than is refined domestically. The result of situations like this is that even major producers of crude oil will actually import/export crude and petroleum products from/to other countries. This results in a robust trade of crude and products around the world. This trade has been complicated by recent sanctions by Western countries that were imposed due to their disapproval of certain activities of other countries around the world. The sanctions have resulted in higher crude prices for those countries that have imposed such restrictions.

Table 1. Production of Crude Oil by Country

Yet another facet of the global trade of crude oil is that the demand for particular petroleum products can change over time. In part one of this series, it was pointed out that refineries do not have infinite flexibility in the types of crude oil that they can efficiently process. Even though a tremendous amount of planning is put into the construction of a refinery, it is inevitable that things will change over time, and the refinery units may need modification (at great expense) to accommodate the changes. Several examples:

Decades ago, U.S. refineries were modified to handle heavy sour crude from South America and several other countries because of its much lower price. The refinery modifications took advantage of new process technology that made the economics favorable for the refiners. However, the U.S. has greatly increased its production of crude oil over the last 20 years or so, but the additional crude has been of a different composition (much lighter API gravity, and lower sulfur content) than the heavy sour crudes previously used. Due to logistics savings of using domestically-produced oil, a number of refineries have gradually made changes in order to become more efficient at refining such feedstocks. The light crudes that are being produced in the U.S. are also finding homes in other countries via export shipments.

European refineries have historically used medium/heavy crudes in order to maximize middle distillate production because diesel has been the transportation fuel of choice in Europe. However, concern over particulate matter in the air (PM2.5, caused by diesel combustion engines), has led certain government agencies to ban diesel automobiles. These requirements were to be implemented over time, but government sanctions on Russian crude have exacerbated the problems now being faced by refineries that were designed to efficiently process the Russian crudes. This also introduces logistics challenges because the newly-sourced crude cannot be delivered as efficiently as the pipeline deliveries from Central Asia. In fact, the “lost” deliveries of Russian crude have been somewhat replaced by crude from the Middle East and the U.S. via ocean-going vessels (see Fig. 1).

As a follow-on to the previous bullet-point, recent events in Yemen have resulted in a reduction in shipments of all commodities through the Suez canal, and this may evolve into a cessation of such shipments. Those vessels that have been re-routed will experience at least a one-month delay in reaching their destination due to the longer route around the African continent and the likely need to re-bunker (new shipments will see about 14 days of additional transit time, compared to “normal” transit times). So, some destinations will be essentially cut off from some crude (and products) supply for a period of time. Crude from the Middle East to Europe will be affected, and this can become a major problem for Europe in the short- to mid-term. As for crude supply, we must bear in mind that the belief that “one crude is just like another crude” is not true, and many refineries rely on consistent supply of different grades of crude that they blend together before sending the blend into the refining process. The absence of just one component in the crude stream will result in poor efficiency in the refineries, and will ultimately cause shortages in products that are needed by the public. Stay tuned for price escalation of oil and, consequently, fuel in Europe.

An interesting aside: Israel imports its crude oil via ocean-going vessels, since the nearby Middle East oil producing countries are not friendly. Israel has three ports that receive oil vessels, and the biggest one (Ashkelon) has been closed due to its proximity to Gaza . Eilat, a smaller port, is on the Red Sea, and is also questionable now. The reduction/cessation of tankers transiting the Red Sea will have a dramatic impact on Israel’s energy sourcing and economics.

Figure 1. Crude Oil Imports to EU (“Other” includes the Middle East)

It might be somewhat surprising, but crude oil, even though it is considered a commodity, is not fungible. That means that crude oil from one oil field/region cannot be directly replaced by oil from another region. Managing supply of crude to a refinery is a very complicated job!

Historically, crude oil has been priced in US dollars (USD). This was an agreement made many years ago between Saudi Arabia and the U.S., and other oil producers readily adopted the same policy for their crude sales. This played a major role in making the USD the global reserve currency. It also resulted in the U.S. shifting the burden of its debt onto other countries worldwide. However, this position is being challenged by other countries, and we may see some changes in the future. I am sure that Aleks will have something to say about that in his next installment of “Economics and Empires”.

Table 2 shows the production and consumption of crude and products in most of the countries in Europe (UK and Norway are major oil producers, so they are shown in Table 1). Most of the countries in Europe produce little to no crude oil, making the continent a big net importer of crude. As mentioned above, these countries are dependent upon oil producing regions, and geopolitics play an important role in the vitality of European economies as the sourcing of crude oil changes in Europe. We can already see some of the changes in the political landscape in recent European elections. More changes will likely come.

Table 2. Europe Petroleum Products Consumption

For the sake of completeness, Table 3 shows the production and consumption of crude and products for various large-consuming countries. As some of these countries further develop economically, their consumption will grow, and they will become even more dependent upon oil-producing regions.

Table 3. Large Consumers of Petroleum Products

Logistics

Wellhead

Oil wells are found on land and in marine environments, such as in the North Sea, the Gulf of Mexico, and off the coasts of many countries where oil is found onshore. Many onshore oil wells (“mom and pop” wells) only produce small amounts of oil each day, 10 barrels or less (a barrel, or “bbl”, holds 42 gallons of oil). A storage tank is generally located near the wellhead, and the oil is pumped into the tank for storage until a truck can come by on a regular schedule to collect the oil. Most oil wells also produce some water, and a water truck will occasionally stop by the storage tank to collect the entrained water. This is pretty easy because the water settles below the oil in the tank, and a valve located at a low point on the tank allows the water to be collected. The oil from the wells is transported by truck to a collection terminal, where it is aggregated with oil from other (local) wells. Crude is transported as described in the next paragraph.

Storage Terminals

Commercial oil wells generally produce from 500 to 5,000 bbl/day. At the high end, that volume is equal to about one Olympic-sized pool every three days. Put another way, that is about 550 liters (145 gallons) per minute! This large volume requires proportionate storage capability, and the larger wells are often connected to collection terminals via pipeline.

Onshore collection terminals are usually connected via (large) pipelines to oil storage terminals located closer to the refineries that process the oil. Collection terminals can usually also load railcars, and a typical configuration of train in the U.S. consists of 80 to 100+ railcars of oil in a single train (with three to four locomotives). These are called unit trains, and they usually get priority on the interstate railroads in the U.S. so that the oil can be delivered over long distances in a very short time, usually travelling distances of over 1,000 miles in just a few days. A large unit train (~110 railcars) can contain 75,000 bbl (3.15 MM gallons) of crude oil, and an efficient terminal can ship or receive 2-3 unit trains per day.

In addition to domestically produced crude, the U.S. refineries are also supplied imported oil by underground pipelines that transport crude from coastal ports to inland locations. The coastal terminals receive imported oil that is delivered by vessels. The inland refineries are located close to the pipelines for ease of delivery of the crude.

In Europe, domestic crude production has been steadily declining over the years, and is now about 350k bbl/day. Since Europe relies on imports of crude and products for ~95% of its petroleum requirements, the refineries have been located on or close to the underground pipelines that transport the imported crude from coastal ports inland to the refineries. I am not aware of any significant delivery of crude oil by rail in Europe.

Vessel Logistics

Since crude is traded globally, ocean-going vessels handle the lion’s share of the workload to transport the oil from source to destination. Crude is transported in dedicated tankers (only crude oil onboard), and the vessels are sized to the largest dimensions that are allowed on the shipping lanes that they transit. This is to take advantage of economies of scale to decrease the overall cost of the oil at destination.

Vessels that transit the Panama or Suez canals are size-restricted. “Size” refers to not only width (beam), but also height above water, and depth below water (draft). And “water level” can change with season and temperature (buoyancy)!

Vessel size varies from MR (Medium Range) to ULCC (Ultra Large Crude Carrier). Between these extremes, crude tanker sizes are called LR1 and LR2 (Long Range), and VLCC (Very Large Crude Carrier).

Medium Range tankers can carry 500,000 bbl (80,000 m3), while ULCCs can carry up to 2,800,000 bbl (456,000 m3).

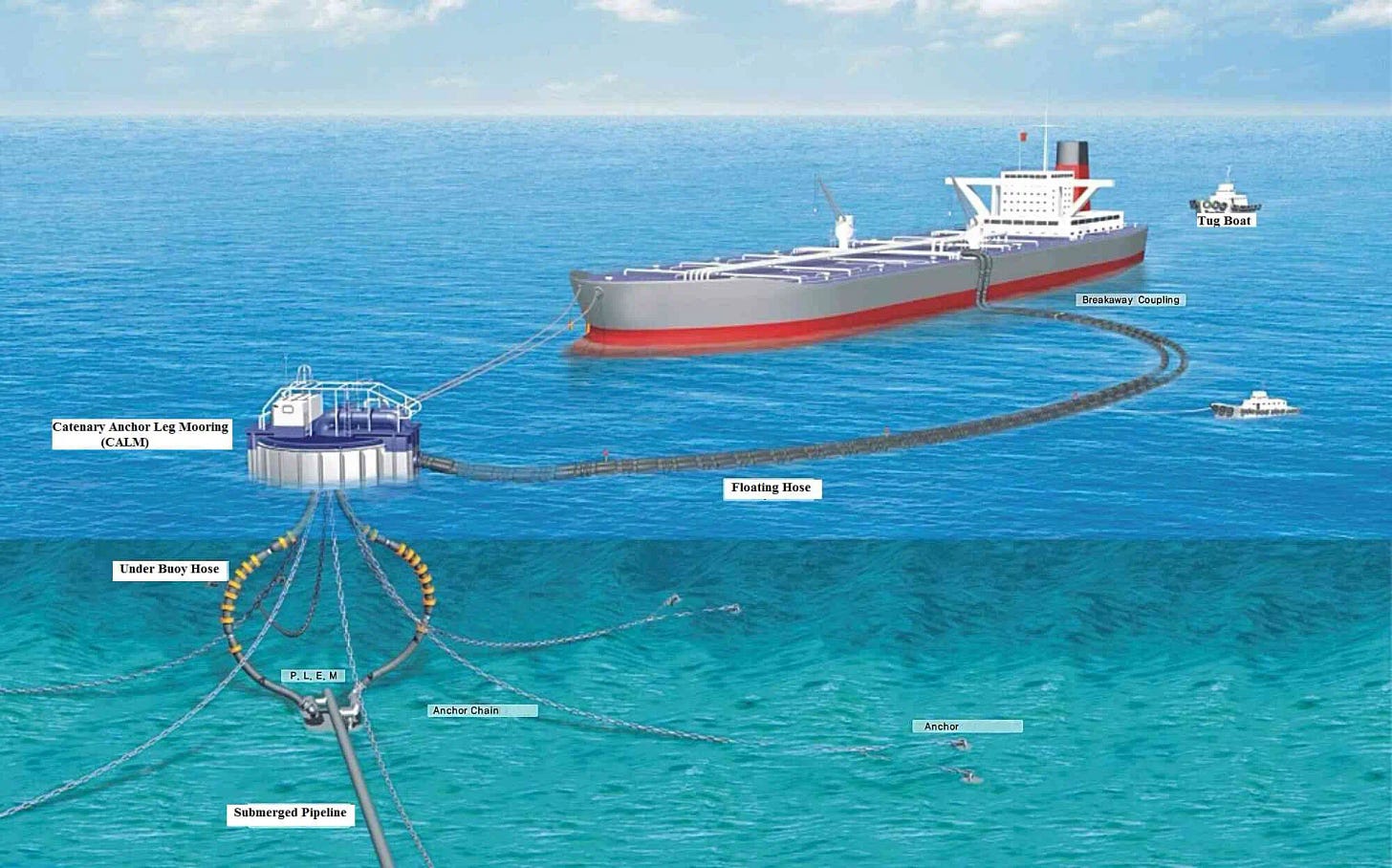

The large size of the crude carriers, usually the draft, limits their ability to enter many ports while fully laden with oil. In the past, it has been common practice to discharge some of the cargo to another vessel while still in deep water (called lightering). With the increase in exports of crude from the U.S., the reverse process has been used, where smaller vessels load at port, and discharge cargo onto the larger vessel by reverse-lightering. Over the last few years, it has become more common, due to efficiencies gained, to permanently place floating buoys that are connected by pipeline to onshore storage tanks, and are capable of loading vessels safely in deep water. This type of infrastructure is now also available to discharge large vessels in deep water directly to onshore storage tanks (see below) for crude oil imported into the U.S.

Figure 2. Floating buoy (Single Point Mooring) for discharge/loading of crude oil.

Offshore Oil Production and Handling

Offshore oil wells deliver the oil to collection terminals via subsea pipelines, and the oil is usually conveyed to onshore oil storage facilities.

One interesting oil storage facility in the U.S. is located in Louisiana, and it is called “LOOP” (Louisiana Offshore Oil Port). LOOP receives imported and domestic (offshore) crude oil. The imported oil is delivered by vessel to offshore buoys, and the domestically produced oil is pipelined to the LOOP system. The oil is pumped through pipelines to the LOOP storage facility where it is put into underground salt caverns. These caverns are large, man-made cylinders that are drilled into solid salt deposits. The cylinders always contain liquid, which consists of the crude oil and saturated brine (saltwater). The brine is saturated, so it does not dissolve any of the salt in the cavern and the cylinders retain their form. When oil is added to a cavern, the brine is displaced into an above-ground reservoir for storage. Conversely, when oil is needed for delivery to another terminal, brine is pumped back into the cavern, and it displaces the oil into the appropriate pipeline for the desired delivery. See this informative video describing the process:

.

Now that you know how LOOP works, you also have a good idea of how the U.S. Strategic Petroleum Reserve works. While the process of storage in salt caverns is similar, it is apparent that the SPR caverns have not been maintained as rigorously as the LOOP caverns. It is feared that the SPR caverns will not long survive the recent drastic emptying that has been experienced while the current administration in Washington, D.C. has tried to reduce the cost of gasoline in the U.S.

Delivery of Oil to Refineries

The last leg of the journey for the crude is the delivery to the destination refinery. As we have seen above, refineries have somewhat limited flexibility, and efficient operation of the refinery requires that the crude coming into the refinery process have the necessary characteristics. From the first installment of this series, we remember that the API gravity gives a rough indication of the level of desired components (gasoline, diesel, jet, etc.) in the crude mixture. A detailed distillation profile, however, is needed to accurately determine the concentrations of the desired components. It is rare that a single crude oil will meet a given refinery’s optimum specification, and that specification may change seasonally. Therefore, it is common practice to maintain enough storage tanks that will allow crudes of various specifications to be segregated, and then blended prior to introduction to the refining process. Some refineries have large “tank farms” that are comprised of very large tanks at or near the refinery. In other cases, third party terminal companies provide tanks for lease, and these very large tank farms may be located miles from the refineries that they serve. In any event, crude blending (prior to refining) is an everyday occurrence in the refining industry.

In the U.S., the advent of shale oil production has added another challenge to the refiners. This crude is very light (high API gravity), and often contains very low molecular weight hydrocarbons that are not suitable for transportation fuel. To make these crudes more suitable for the big refineries, Topping units have been built to pre-treat the crude to remove the lights that would otherwise overload the distillation unit in the first stage of refining. Some Topping units have been built within the existing refineries, others are standalone facilities that then sell the pre-treated crude to several refineries.

This discussion has hopefully given you a snapshot of the refining industry and a view of some of the challenges that are faced by refineries every day.

If you like this article, please consider buying me a coffee. A lot amount of work goes into writing a researched article like this. This is the second of 3 installments on Crude Oil, and we have several other topics to write about in the near future. If you have any suggestions of what you would like to see, please add it in the comment section. Thank you!

Excellent!

Thank you for a very informative post.