Preamble

First, I would like to express my appreciation to Aleks for allowing me the opportunity to write a few articles on his website. It is an honor!

I have been a commenter many times on various articles on the web, and that generally takes minimal effort to express one or two thoughts/opinions. However, assembling a series of thoughts and facts on a given topic into readable prose, without boring the reader, is quite an undertaking. I will give it a shot, but I am counting on you, the reader, to let me know if what I write is understandable and worth your time to read, or if it is too detailed, boring, etc.

This article will contain basic information for people unfamiliar with the topic at hand, followed by discussion related to the current pertinence of the topic. For those of you who are familiar with the basics, just skip the “Basics” section and go to “Worldwide Natural Gas Consumption”.

Natural Gas

Natural gas has become a very important commodity in the world as we transition from fossil fuels to alternative forms of energy. The goal is to reduce the emission of greenhouse gases worldwide and natural gas, being a very efficient source of energy, has a lower “carbon footprint” than other fossil fuels. I believe that the critical importance of natural gas has been ignored in many countries in Europe, and I will describe the potential outcomes of such ignorance.

Basics: What is Natural Gas?

Natural gas is a colorless, odorless gas that is flammable and easily ignited (for safety, an odorant is added in order to easily detect leaks). Natural gas is comprised of the simplest hydrocarbon in existence, methane, along with several impurities (more later). More importantly, natural gas is a very useful form of energy, and I will make a detour to briefly discuss energy.

Cheap, readily available energy is requisite for the development and sustainment of civilization. The lesser-developed countries in the world suffer from a dearth of cheap, reliable energy.

In general, crude oil, natural gas, coal, the sun, and wind are sources of direct energy from which heat and/or electricity can be derived. Fissile materials can also be used to generate electricity (nuclear energy).

Solar and wind energy are dilute forms of energy, meaning that the direct energy must be concentrated before it can be useful in societies. This is almost always accomplished by conversion of solar and wind energy to electricity. Nuclear energy is a very dense energy, but for various reasons it also is used almost solely for generation of electricity.

On the other hand, crude oil and natural gas are relatively concentrated forms of energy, and this makes them particularly suitable for use in transportation. Natural gas is also used increasingly in electricity production because it has a lower “carbon footprint” than coal. Note that crude oil is not typically used for generation of electricity. This is because crude oil derivatives are much more valuable in transportation applications.

Importantly, crude oil derivatives and natural gas are also very valuable building blocks for making myriad products such as plastics, pharmaceuticals, food additives, steel, and many more. In the hypothetical world free of “fossil fuels”, one wonders how these vital products will be produced in sufficient quantities to support modern civilization.

Where is Natural Gas?

Natural gas is found in geologic formations that contain crude oil. Crude is comprised primarily of hydrocarbons of various molecular weights, and as mentioned above, natural gas is a simple hydrocarbon. So, drilling for crude oil usually results in finding natural gas along with the oil.

Since oilfields are often found in remote locations, the oil and gas must be transported long distances to reach the intended markets.

The most efficient way to transport natural gas to its final destination is by subterranean pipelines. Since a pipeline cannot be moved once installed, pipeline projects are intended to move very large quantities of gas from the oil/gas fields to a termination point that is strategically located to distribute the gas to various consuming locations. Thus, pipelines are built with the expectation of moving huge quantities of gas over a very long period of time. The suppliers and the customers agree on long-term contracts for the supply of gas. Long terms are necessary to amortize the huge cost of construction of the pipeline system.

Worldwide, there are almost a million kilometers of industrial-size natural gas pipelines in operation.

Another way to transport natural gas is to compress and cool the gas until it condenses into a liquid (called liquefaction, at -162 C). This liquid is called (of course!) Liquified Natural Gas – LNG. The liquid form takes up a space that is about 0.17% of the volume of an equivalent weight of gas. Put a different way, an LNG vessel that contains 170,000 cubic meters (cbm) of LNG actually contains 102,000,000 cbm of gaseous natural gas once it is allowed to expand to its natural state. BTW, 170,000 cbm is the size of a medium/large LNG vessel. In this article, I will distinguish between liquid volumes and gaseous volumes by using “LNG” and “gas” when describing the quantities of product in the two states.

Several island countries like Taiwan (China) and Japan, and the pseudo-island country of South Korea rely heavily on LNG deliveries by seaborne vessels. That is because it is impractical to build subsea pipelines for delivery of natural gas to these countries.

Worldwide Natural Gas Consumption

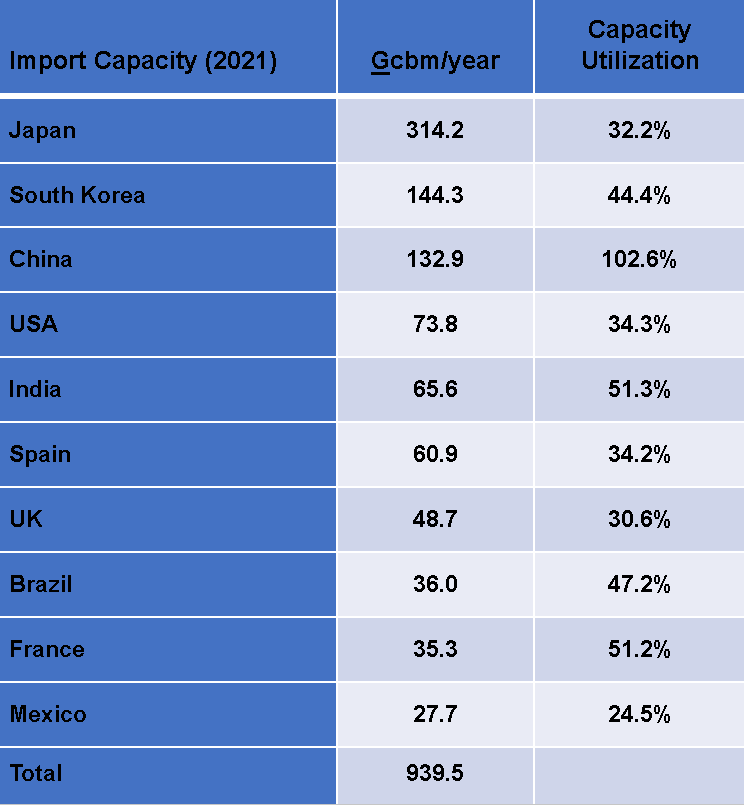

The world consumes about four trillion cubic meters of natural gas per year. Over 100 countries use natural gas, either produced domestically or imported. Most of this gas is delivered by pipeline, but an increasing share of the natural gas is delivered as LNG. Table 1 shows the import capacity of the world’s largest importers of LNG, along with their capacity utilization (for 2021). The infrastructure to receive LNG in 2021 had the capability to process almost a trillion cbm/year (gas, not liquid), while the exporting countries’ infrastructure to ship LNG was only 545 billion cbm/year of gas (Table 2).

Table 1. LNG Import Capacity (Gas)

Note that the capacity to import LNG far exceeds the actual volumes of gas that have been processed by the LNG export terminals. This may reflect the fact that countries are loathe to import a product that is much more expensive than the alternative (pipeline gas); or it may be that the capacity to export/deliver such volumes of LNG has not caught up with the receiving capacity.

Table 2. LNG Export Capacity (Gas)

Environmentalists insist that natural gas is still detrimental to the global climate, and future plans include a transition away from natural gas to other alternative energy sources. With this uncertainty about the future of natural gas going forward, the expansion of natural gas infrastructure (liquefaction, transportation, and regasification) may not continue at the fast pace of development seen in recent years. Countries who are frantically looking to use LNG as a “stop-gap” supply of natural gas for the next five or ten years will face great difficulty competing with customers who have existing long-term contracts for LNG supply, such as Japan, Korea, and Taiwan.

A Further Word on Gas Delivery

As mentioned above, natural gas has historically been transported by high-pressure subterranean pipelines. This method of transport is very efficient, and massive quantities of gas can be transported long distances at minimal cost. Additionally, pipelines are quite safe and not subject to disruption by non-state operatives (e.g., terrorists). Over time, as more pipelines are installed, the pipeline infrastructure develops redundancy such that gas delivery can occur without interruption, even if one particular line needs to be shut down for maintenance.

Things are a little different for LNG

Needless to say, the liquefaction process requires large facilities to compress and cool the gas until it liquefies. This infrastructure is expensive, adding to the cost of LNG vs. pipeline gas. Another factor that increases the cost of production is that the impurities in the gas, particularly the hydrocarbon impurities such as butane, pentane, and higher hydrocarbons must be removed to levels lower than in pipeline gas because they can be a problem at the very low temperature of LNG. Other impurities, such as water and carbon dioxide, must also be reduced to lower levels than in pipeline gas.

In addition to this, the vessels that transport LNG are quite complex, due to the requirements to cryogenically cool the LNG, and deal with emissions from evaporation of the LNG during transit (newer vessels use natural gas-fired engines, thus eliminating the emission problems).

Another factor adding to the cost of LNG is that the LNG vessels are very specialized, and they are not useful for any other cargoes except LNG. Ocean-going vessels can be more efficient if they are able to carry a (different) cargo from the destination back to the point of origin after delivery of the first cargo. LNG tankers cannot do this, and they spend fully one-half of their time traveling empty ($$$).

Economically speaking, the decision to build new LNG tankers relies on a stable market for the LNG worldwide, a market that is relatively new and still uncertain. Suffice it to say that the fleet of LNG carriers is somewhat limited at the present time, and construction of new vessels takes a number of years. LNG shipbuilders are fully booked for the next five to seven years with existing orders.

Finally, the receiving terminals, called regasification terminals, are also expensive to build and the decision to install a new terminal requires guaranteed throughput volumes for a long period of time. The storage tanks for LNG must be refrigerated and well insulated in order to keep the LNG cold to prevent unwanted evaporation. And the regasification process requires a lot of heat to evaporate the LNG when gas is needed.

Because the land-based regasification terminals require long lead times for construction, a relatively new concept has been introduced, called Floating Storage and Regasification Units (FSRUs). These are essentially floating platforms (a vessel that may or may not have an engine) that can be moored at a jetty, and act as a receiving terminal for LNG. The jetty typically has a pipeline connection to natural gas infrastructure at the port where the FSRU is moored. The FSRU has storage tanks for the LNG, as well as the heating capacity to turn the LNG into gas that goes into the pipeline.

The storage tanks on the FSRU allow the delivering vessel to offload and leave in a relatively short time (1-3 days). Making the delivery vessel stay for the time it takes to gasify the LNG would be prohibitively expensive, because the vessel’s time is very costly (thousands of US$/hour). It may take a week or more to gasify the LNG that is delivered by one large vessel.

As you can see, numerous factors cause the cost of making, shipping, and receiving LNG to be considerably higher than for the competition, pipeline gas. Even worse, LNG is not a true commodity because the complexity of the logistics involved make barriers to entry quite high. Therefore, market forces greatly favor the suppliers, and pricing is disengaged from cost by a large factor. For example, at the time of writing this, the benchmark price for natural gas in the U.S. is $2.18/MMBTU, while the Japan/Korea LNG Marker is $11.24/MMBTU (5x). This price differential was even greater during the recent Fall/Winter months.

A comment about LNG, particularly with regards to the FSRU development: One has to question the security of such exposed infrastructure, particularly in these volatile times.

Natural Gas in Europe (not including Scandinavian Countries)

Europe has used natural gas for countless years, as a source of energy for electricity generation, as a heat source, and as a chemical feedstock. Europe, including the UK, consumes about 500 Gcbm of natural gas per year. Domestic production of natural gas in Europe is relatively small (44 Gcbm/year), and Europe imports gas from various countries in Eurasia as well as from the North Sea and North Africa. All of this gas was historically transported by pipeline, but for the last several decades, LNG has been a growing source of natural gas to Europe. This means that the number of suppliers has increased (Middle East), although LNG is not normally cost-competitive with pipeline gas. Thus, factors other than cost have influenced decisions to purchase the more expensive LNG.

Table 3 shows some European countries and their natural gas consumption, as well as some of the LNG terminals that are currently operating. Remember that many LNG receiving terminals are not operating at nominal capacity.

Table 3. Europe Natural Gas Consumption and LNG Terminals (2022)

A key factor that has led to the growth of LNG in Europe is the security of supply, considering that pipelines are controlled by countries that are increasingly being viewed as hostile (Russia), or hostile and greedy (countries through which pipelines pass charge a tariff for the gas that passes through their territory). Another consideration is that, as (expensive) renewables grow in use, the cost of energy is not as big a factor as the greenhouse gas considerations. As stated above, natural gas is a way to transition from fossil fuels to renewables because it has a lower carbon footprint than conventional fossil fuels.

To analyze the situation for the individual countries, it is convenient to separate the countries that use natural gas primarily for heating and electricity generation from the countries that also have significant chemical and industrial use of natural gas.

The value of natural gas that is used as a building block for chemicals is considerably higher than the value for its heat content (home heating or electricity generation). However, that does not mean that a chemical or industrial user can afford to pay an exorbitant price for the natural gas. Those industries are very competitive, and the cost of the methane is a significant portion of the price of the commodities produced from it. Thus, the cost of natural gas, in whatever form it arrives, determines the ability of the user to bear the burden, depending on the ultimate application.

OK, let’s get to the heart of the discussion (finally!)

Many of the countries in Europe rely on natural gas primarily for heating and electricity production. These countries do not rely on heavy industry to drive their economies, but instead have robust tourist, financial, electronics, and service industries. A number of these countries have already turned to LNG for partial supply of energy for heating and electricity. Examples are Spain, Portugal, and France (which also relies heavily on nuclear energy for electricity generation). Prior to the SMO in Ukraine, these countries could accommodate the additional cost of the imported LNG via social welfare mechanisms. But because of the EU sanctions on Russian pipeline gas, the people in these countries struggled to stay warm last winter and they are wondering how they will be able to pay their electric bills. As we come into summer the problems are easing, but no solution is in sight for next fall/winter. Looking for additional volumes of LNG to alleviate the situation is a fool’s errand, because the infrastructure to deliver significantly more LNG to Europe does not yet exist.

Only a few heavy-industry countries in Europe have large use of natural gas for chemical/industrial applications. These countries are Germany, the Netherlands, Poland, and Italy (we will have to skip Ukraine for obvious reasons). The key industries in these countries are steel, fertilizer, chemicals, and other vital commodities. Overall, Germany has a greater use of natural gas in these applications than the other countries mentioned here.

And Germany, which has been called the economic engine of Europe (the EU in particular), is where I will focus.

Germany’s large industrialized economy is said to be the second largest export economy in the world, after China. Aside from robust exports to other European countries, Germany exports goods to many countries worldwide. Germany is a leader in exports of automobiles, aircraft parts, pharmaceuticals, refined petroleum products, medical equipment, and many other products. Germany has long been a leader in the production of chemicals, both commodity and high-value-added chemicals. And all of this activity requires a lot of energy, much of which has been provided by natural gas in the past. And some large-volume chemical production processes require methane as a raw material, e.g., ammonia.

I think that it is safe to say that Germany is among the two or three European countries whose economies are critical to Europe’s economic success and stability.

So how does natural gas factor into this story?

For Europe, and Germany in particular, the world changed abruptly in February of 2022. For reasons that I will not discuss, a series of decisions were made that I think irreversibly altered the fortunes of all European countries, to one degree or another. I will list the events that have led to the current (bad) situation for Europe, and after each event I will give a brief description of results:

As part of the sanctions by the West, Europe began disputing the way that pipeline gas from Russia would be purchased, and Russia eventually stopped sending gas to Europe through the Nordstream pipeline. Russia’s decision was precipitated by the insistence of Europe to pay for the gas in currency that Russia could not use.

Results: Prior to this, Russia had supplied 52% of Germany’s natural gas requirement. Germany has increased purchases of gas from Norway and the Netherlands, but these supplies are small and Germany is still short of energy going forward.

In September 2022, the Nordstream pipeline system was severely damaged by a series of (intentional) explosions. Prior to this, it was believed by some that Germany was in quiet discussions with Russia about resuming use of the pipeline system.

Results: It will take years to develop infrastructure and supplies in order to replace this lost resource. In 2022, Germany implemented an emergency plan to build numerous LNG import facilities, but in 2023 Germany reduced the planned expansion due to resistance of the people.

Germany decided, at the insistence of the Greens, to shutter the three remaining nuclear power facilities earlier this year. These plants represented 6% of Germany’s total energy requirement.

Results: This will put an even greater strain on Germany’s ability to maintain the well-being of its citizens and the economy in general, because it will not be able to provide affordable, reliable sources of energy.

Because of fears of a cold winter in 2022-23, Germany implemented a severe austerity program to conserve resources. This program included:

Regulations to lower home, school, and office heating demand. This included requirements to reduce the temperature of water heaters.

Shutdowns of energy-intensive industries such as steel and chemical production facilities, as well as gas-fired electricity generation. Ammonia production, a large consumer of natural gas, was also reduced.

Results: The austerity measures, taken for reasons not appreciated by the general population, have resulted in a groundswell of resistance to further tightening measures going forward.

Results: Europe was able to stockpile gas inventories in summer 2022, making it easier to have gas for the winter. This will not be as easy in 2023, because gas, any gas, will not be as plentiful going forward ... and it is significantly more expensive (LNG 5x price vs pipeline deliveries).

Results: Due to the curtailment of natural gas supplies, Germany has ramped up electricity generation by the most evil of energy sources … coal. Coal now provides about one-half of the energy consumed in Germany. This flies in the face of the goals of the “Greenest” country on the planet. And it remains to be seen how long German leadership will be able to count on this source of energy to keep the people comfortable and somewhat happy.

German leadership made valiant efforts to get other countries to commit to supplying more natural gas as soon as possible, entering discussions with many countries, including countries in the Middle East.

Results: No pipeline gas quantities are available to provide additional gas to Germany, and it will take years to plan, permit, and build new pipeline capacity.

Results: Current LNG export capabilities are sold out, and obtaining new supply in one or two years is not a promising prospect. For example, Germany has only been able to get agreement for 2.8 Gcbm/year of natural gas in the form of LNG from Qatar … starting in 2026!

Germany and the EU have enthusiastically proposed and implemented myriad economic sanctions on Russia and others. Sanctions represent economic isolationism, which is evidenced by the difficulties that the German economy now faces.

Results: The sanctions, along with higher energy prices due to natural gas shortfalls, have led to contractions in business outlooks going forward.

China has become a significant trade partner with Germany over the years, and Germany has “offshored” some chemical production to China.

Results: Germany’s economy is more dependent upon China trade than it has been in the past. This will make future cooperation with the U.S. in its conflicts with China more difficult. Loss of business cooperation with China could result in a death knell for some German industries.

The U.S. has enticed some German manufacturing companies to relocate their production to the U.S., offering economic incentives to enhance the manufacturing sector of the U.S. economy.

Results: German companies such as OCI, BASF, and Arcelor Mittal are in the process of relocating manufacturing processes to the U.S. This will further deteriorate German productivity.

Last but not least, Russia has aggressively pursued major customers in countries other than Europe, such as India, Brazil, and China. For example, the Power of Siberia gas pipeline from Russia to China, and the business models that Russia is pursuing are based on long-term agreements of supply. These efforts are going a long way toward replacing the business in Europe that has been “lost”. And Russia will not consider re-opening business discussions with European countries such as Germany because of the distinct lack of trust in Europe, and the West in general.

It has become apparent that the decisions made by the leaders of Europe and the collective West have resulted in an irreversible rift between these countries and Russia. And this rift will ultimately result in a significant reduction in the economic viability in those countries opposed to Russia, such as Germany and other countries in Europe.

Add to this the fact that a significant number of big countries have taken decisions to increase business with Russia with long-term goals in mind. Successful reorientation of Russia’s business objectives has made it clear that they will not go back to the way things were before.

If you like this article, please consider buying me a coffee. A massive amount of work goes into writing a researched article like this. I plan to write more, and Aleks has a list of suggested topics. If you have any suggestions of what you would like to see, please add it in the comment section. Thank you!

You guys give to much credit for an export-led, deflactionist country like Germany.

It has been the consumption sinkhole of the world economy since the Aughts. It's demise - better, the demise of his mercantilist economic model will be a godsend to the world economy.

Sadly, it happened thanks NS demise and not € demise, but that's history.

Europe has registered 68000 excess deaths last winter, attributed to the energy crisis.

https://www.economist.com/graphic-detail/2023/05/10/expensive-energy-may-have-killed-more-europeans-than-covid-19-last-winter

Perhaps the collapse of energy-intensive industry in Europe will make the next winter less deadly, but I doubt it.

Those floating gas terminals sound like juicy targets in any potential conflict.

Speaking of pollution, it appears a large part of the Depeleted Uranium shells the UK has supplied to the Ukraine has been destroyed in Khmelnisky, leading to a 50% increase in gamma radiation in the area, from 95 nSv/h to 150 nSv/h.

Source: EU monitoring data https://remap.jrc.ec.europa.eu/Advanced.aspx

Depleted Uranium is a very weak gamma emitter, IIRC 95% of its energy emissions are alpha particles, which are normally harmless when released outside the body, as they can be blocked by clothing and skin. However, when they are released inside the body, say, after inhalation of DU dust or consumption of contaminated foodstuffs, the effects can be truly devastating. Not to mention the toxicity of Uranium as a heavy metal.

How unfortunate for the Banderite regime that the DU shells that were meant to contaminate New Russia aka Eastern Ukraine were instead destroyed in Western Ukraine. Perhaps they will console themselves with the fact that a portion of the dust has spread to Poland, as Poles are another group that Bandera has targeted for genocide.